Taxation

Taxation

We administer, collect, enforce, and maintain the tax expenditure and rates through the Penticton Indian Band tax and assessment laws. Maintain effective communication with taxpayers and band members.

Maintain consistency with the annual tax cycle.

Please use the following extensions when calling Taxation or Utility billing:

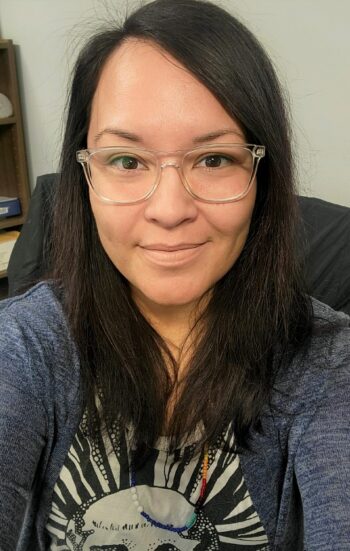

Tax Clerk – Carmen, Ext. 233

Tax Administrator – Carlene, Ext 232

For information regarding the following:

Taxation

• Tax searches

• Title searches

• Tax laws

• Account details

• Payment methods

Utility billing

• Utility invoices

• Payment methods

• Account details

** Please be advised that The Penticton Indian Band Property Taxation Department charges $50.00 per tax search requested, as per Section 21(1)(2) of the PIB Property Taxation Law 2015. **

** There is a $30.00 non refundable fee payable to the Penticton Indian Band when you appeal your assessment, as per Section 29(1)(c) of the PIB Property Assessment Law 2015. If the appeal fee is not submitted with the written notice of appeal the assessor shall advise the appellant by registered mail that the appeal will be deemed invalid if the appeal fee is not received in the office of the assessor. **

Important Tips to Penticton Indian Band Taxpayers

YOU ARE ENCOURAGED TO WEAR A MASK. ONLY 2 TAXPAYERS IN THE OFFICE AT ONE TIME

Methods of payments:

- Credit Card / Debit – in person by machine * New awesome option

- Cheque – in person or mail

- Money order – in person or mail

- Cash – in person

- Online – if your bank accepted PENTICTON INDIAN BAND TAXES

- Apply for your grant online OR in person

Was your name or address incorrect on your annual BC Assessment Notice that you receive in January?

- If you see incorrect information on your BC Assessment Notice, please contact BC Assessment and notify them of any changes you require. We also ask that you also notify the PIB Property Taxation Office as well as.

If you did not receive a tax notice:

- Recently bought a new place, the tax notice may have been sent in the previous owner’s name, if that’s the case also confirm with your lawyer or notary that your portion of taxes were adjusted at the time of sale.

- Purchasing an existing property on PIB, we may have not been notified that you’re the new owner.

Did you receive a tax notice for a property where you no longer occupy?

- Please forward the tax notice to the new owner

- Return the notice by mail to the Penticton Indian Band Property Taxation Dept.

Instructions for paying your property tax online:

- Add Payee: PENTICTON INDIAN BAND TAXES

- Account: your folio number starting with the number (don’t add all the zeros)

- Other methods of payment: Cash, Cheque, Money Order, payable to the “Penticton Indian Band Property Tax“

Understanding Property Assessments and Property Taxes

BC Assessment Video: Understanding Property Assessment & Property Taxes – https://www.youtube.com/watch?v=GJ1mzeCm5jw

Useful Property Taxpayer Information

LINK: Reserve Land – By Location

If you are a non-member leaseholder on reserve land, you need to pay property taxes. Who you receive your property tax notice from, and pay, depends on whether the First Nation charges its own property taxes. When the First Nation charges its own property taxes, they will send your property tax notice. You pay your property taxes to the First Nation.

You are not eligible for the provincial property tax deferment and home owner grant programs when you pay property taxes for your principal residence to a First Nation. However, the First Nation may offer its own home owner grant program.

If you have questions about your property taxes, contact the First Nation.

If the First Nation doesn’t charge property taxes, your taxes will be administered by the municipality or the province if the property is located in a rural area.

Online Grant Applications

(Note that you can also still apply for the annual grant in person or by mail)

Taxpayers can apply for the Home Owner Grants through the online portal. The tax team will review and approve each grant that comes through for the appropriate information and you will receive a confirmation email back once approved. Please reference the back of the tax notice for grant qualifications.

Home Owner Grant Website Login:

https://homeowner.smartgroupsoftware.com

You will need to have your assessment ID and your access key – found on your tax notice!

Example:

Assessment ID: 151988 (the 6-digit number)

Access Key: 7FAPPW

Important Contact Information

LANDS

Deaths, leases, new registration, title

- A certified true copy of the death certificate

- A cover letter which includes the nature of the registration and context, legal description of the lot

- Once registered the interest will transfer to the surviving joint tenant

Indigenous Service Canada

Lands and Economic Development

1138 Melville St.

Vancouver, BC

V6E 4S3

ATT: BC Land Registry

Phone: 1-604-775-5100

BC Assessment

Name, address changes

- Detailed information and instructions are on the BC Assessment notice you receive annually in January

BC Assessment

300-1631 Dickenson Ave.

Kelowna BC

V1Y 0B5

Phone: 1-866-825-8322

Ownership, Transfers, Details…

Manufactured Home Registry

PO Box 9431 Stn Prov Govt, Victoria BC V8W 9V3

Ph: 250-952-7976 Fax: 250-387-3055

http://www.bcregistryservices.gov.bc.ca

BC Assessment Contact: 1-866-825-8322

300-1631 Dickson Ave, Kelowna BC V1Y 0B5

Website: http://www.bcassessment.ca

External Links

Helpful Information

- Explanatory Notes For the Home Owner Grant

- FMA (First Nations Fiscal Management Act) Notice 2015

- First Nations Property Taxation Guide

- Rates Law Standards – Districts, referencing jurisdiction, transition plan…

- Expenditure Law Standards – Budgeting

Property Taxation Audited Financial Statements

District 2 Transition Rate Plan

This applies to the taxpayers who have been Penticton Indian Band Taxpayers since 2008

- Initial Rate Transition Notice

- PIB Reference Jurisdiction Transition Plan

- NOTICE: Transition Rate Plan Information Meeting

- Penticton Indian Band Transition Plan PowerPoint

View annual expenditure (budgets), rates, tax and assessment laws from 2008-Current

Instructions on how to view Penticton Indian Band information:

- Click the red box – PART II – Laws and By-laws, codes and other enactments

- Search all – Search for: Penticton Indian Band

- Will show a list of everything pertaining to PIB

Click the link and follow the above instructions: First Nations Gazette

Videos/Audios

- Bundle of Arrows: The Evolution of Tulo Centre Programing: https://www.tulo.ca/podcast/bundleofarrowsepisode1

- Bundle of Arrows: Taxpayer Communication and Relationship Building: https://www.tulo.ca/podcast/bundleofarrowsepisode2

- Success Story – Penticton Indian Band: http://fntc.ca/penticton-indian-band/

- Other First Nations/Bands Success Stories: http://fntc.ca/videos/

- How BC Assessment Assesses Properties: https://www.youtube.com/watch?v=ErfOwlpRDFM

Current & Past Information

* 2023 Information * *

- UNPAID TAXPAYERS – Arrears notices have been sent out in the month of January 2023

- If you are a new homeowner for part of the 2022 year and have unpaid property taxes/utilities, please ensure you look at your sale documents to see the credit payment from the previous owner (seller) for their portion of the property tax, your responsible for the remainder of the year.

- UNPAID UTILITIES – Notices have been sent out in the month of January 2023

- TAXPAYERS – have until Feb 14 2023 to appeal their 2023 Assessment Notices from BC Assessment provide a letter to BC Assessment and $30.00 Fee to Penticton Indian Band Property Tax Department

* * 2022 Information * *

Contact Us

Join us in celebrating and preserving the rich culture and heritage of Penticton Indian Band's peoples. Contact us to learn more and get involved in our efforts.

Contact Us